Two market 'tells' yesterday in the form of reactions to a Trump win:

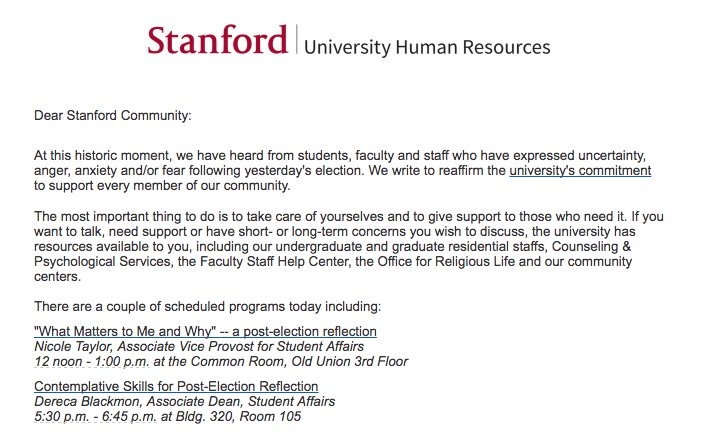

(a) Stanford.

(b) Brett Arends, normally a composed and articulate journalist and financial columnist, lost it in the wake of election results and uncharacteristically lashed out at James DePorre on Twitter.

So it's the real deal. A Trump administration appears to be the catalyst for a continuation of the global bull market. The polls got it wrong. The media got it wrong. The market has it right. A Clinton win was never going to catapult the indexes the way a Trump victory will, all the more so in the face of widespread skepticism and ridicule. DJIA 20,000 is now within reach by the end of 2016, and DJIA 24,000 in 2017 is now a 'reasonable' expectation (at least in my opinion).

Investors hate Trump. Really? Not yesterday, and not this morning. It looks like a +100-point gap-up in the DJIA. Whether individual investors like Trump matters little. The market is prophesying a pretty good four years ahead.

Don't know how to love Trump? Let Yvonne Elliman help you out!

For AAPL at least, that was a mini 'flash crash' just now.

ReplyDelete2nd - I think its too early to make a call just yet, despite yesterdays massive rally. Everyone is calling this Brexit 2.0. I am leaning bull but look at the action vs Brexit. Is it not the exact opposite?

ReplyDeleteActually its really about the sectors...Brexit response in small caps, Financials, Construction, some Bios.. But the opposite in big tech

DeleteX and FCX both holding in strong. Looks like tech is going through a similar rotation as late 2014/early 2015.

ReplyDeleteThe insurers are loving Trump with pretty much all up over 10% in the last 2 days - large caps like MET and PRU, smaller ones more, pretty much the entire industry bouncing with rates as Trump either indicating inflation or growth - doesn't matter, both push interest rates up and these guys are way undervalued and leveraged to the higher rates.

ReplyDeleteDRYS up big today on what looks like a bad earnings report and bad news - maybe a sign that the expectation for the shippers have gotten too low. Looking at ALC.TO in Canada to play - might be too conservative and not get a big bounce because of that, but less downside. Still thinking...

ReplyDeleteYeah I've been researching the sector all morning.

DeleteBack in UGAZ at $21.84

ReplyDeleteSold on the close. If I use the sentiment chart as a guide we have one more big drop and that's where you could potentially hold for a longer term trade.

DeleteBought some FNMA at $2.486 avg. Just thinking if regulations are lifted then you have potentially a big rally in this stock since it's trading at a 0.3 PE

ReplyDeleteIf I would have kept my FCX sell limit order last night, FCX would have definitely continued its rally. But now that I cancelled the order, FCX might have trouble getting over $14 again in the near future...

ReplyDeleteIf your definition of the 'near future' includes the next 30 minutes, you can unload FCX @ $14 in the after hours session right now.

DeleteLooks like I worried for no reason -- copper is up 8c again in the evening session. Man, what a rally. As you said, if I weren't "in" with FCX at the start, I would not have had the guts to buy now.

DeleteEmerging markets took a hit today. It appears investors in Latin America and China are worried about a trade war. I don't think it happens. Trump and Ryan will negotiate deals that make economic sense for all involved. A trade war benefits no one.

ReplyDeleteIf metals are going up in anticipation of construction activity, wouldn't more oil be required to operate all that construction equipment? It would also make it more expensive to build new oil wells. So shouldn't oil price also start moving up soon?

ReplyDeleteOPEC still way overproducing. Some of those countries like Saudi can get it out of the ground for under $5 per barrel, and they have other objectives other than profit maximization.

DeleteThe 10-year inflation expectation are spiking up (red line):

ReplyDeletehttps://fred.stlouisfed.org/graph/?graph_id=87988&category_id=0

That chart is a couple of days behind, but today the difference between 10-year yields and real yields closed at 1.88:

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield

Placed a buy stop limit order for more GDXJ at $38/$38.10

Placed a sell limit order on 1/2 of my remaining FCX at $15. My current position is still too large to just forget about it and let it run...

ReplyDeleteI can't believe how long I've been in AAPL. Hopefully this pullback ends here while I'm still green. HATE red apples.

ReplyDeleteMexican stocks have had pretty steep pullbacks. Would like to get one of the airports down there (ASR, PAC), but still trading at 20 fwd p/e's, so would like to see cheaper. But lower peso is good for Mexican tourism, which will be good for their airports.

ReplyDeleteLooks like we should expect the rally yo continue ->

ReplyDeleteWith help of @sentimentrader, we found 1-day US 10-yr rate spikes of >5% have led to SPX gains six months later EVERY time since 1962. Weds saw an 11% record gain in UST 10-yr yield. History shows you should expect n/t pause in rate rise, rally in #SP500 , and cyclicals win.

And

DeleteRyan Detrick, CMT @RyanDetrick 26m26 minutes ago

#StatOfTheDay The S&P 500 is up 3.5% this week. Going back to '12, when >3% or more, the following week has been higher 9 of 9 times.

Yep, without my sale of FCX the rally could not last...

ReplyDeleteOn the other hand, this pullback is a buying opportunity for ... GDX! I just bought some at 21.60. When gold moves up, if you are not already in, you'll miss it...

OK, screw it. Just sold 1/2 of my remaining position at $13.76. After this sale, FCX accounts for 10% of my portfolio, which is a reasonable fraction, according to all diversification rules, to carry as a long-term position.

DeleteNaturally, FCX rallies after I sell it. :)

DeleteThe chart case for Value finally breaking out above Growth. I've been looking for this all year as the valuation differential had stretched to extreme levels only seen a couple times before in market history, so this breakout could well be the beginning of the trend change.

ReplyDeletehttp://allstarcharts.com/real-story-value-stocks-break-vs-growth-stocks/

Going through my portfolio this weekend and so far up almost 10% this quarter and finally back to my previous peak back in July, 2015. That was a long painful time!

ReplyDeleteLooking at stocks now, so many have had nice jumps, either we are at the start of a very strong market or we get some backing and filling coming up. I've stayed mostly invested this year, so don't feel compelled to chase, but there's been a lot of chatter about investors/funds reducing exposure to the market and building cash, so they have a much harder decision to make.

Dow future up another 100 at 8:30 and bond yields continue to rise.

ReplyDeleteLooks like the rally extends into next week.

But why is oil not rallying??? If economy is indeed set to pick up, shouldn't oil rally too???

DeletePretty sure it is because OPEC is overproducing:

Deletehttp://www.reuters.com/article/us-global-oil-idUSKBN1380YI

"OPEC plans to cut or freeze output, but analysts doubt the group's ability to reach an agreement at its meeting on Nov. 30.

The Organization of the Petroleum Exporting Countries said on Friday its output hit a record 33.64 million barrels per day in October, and forecast an even larger global surplus in 2017 than the International Energy Agency on Thursday. [IEA/M]"

I got lucky on two buys this morning. Bought NMM at $1.46 and DB at $16.03 pre market. I have been watching NMM for the past two days and was unwilling to buy ahead of earnings. Earnings were solid IMO so I had to chase a little.

ReplyDeleteDB is a total dog, but every dog is having its day this year.

I now own X, NMM, FCX, FNMA, DB. So gross.

On NMM I'm just riding the boom in DRYS as I think people are thinking there's a turn at hand for the dry bulkers. BDI has been rallying a lot, up another 7% today to over 1,000. NMM was earning $2-3 a share a few years ago and paying out a $2 dividend. Give me one of those years and I've recouped my investment.

DeleteSorry looks like they were earnings $1.50 to $1.60 a share for a few years and paying a similar sized dividend. Doubt they get back to that unless the BDI skyrockets...but at $1.50 a share I think its worth the risk.

DeleteHaha - you could start a fund "The Gross Porfolio". I'm sure you're not the only one who thinks they're gross, so won't take much positive news to see some good moves.

DeleteLooks like the bear market in small caps is over

ReplyDelete> Russell 2000 close to a new high for the first time since June 2015. Saw a 27% drawdown in between.

Yes, have gone vertical, where to step in is the question.

DeleteCX went long CX @7.45 Trump is going to need lots of cement and it has corrected. I'm not sure if the mkt will overlook that its a Mexican company, but it should. I'm not sure the names of other cement companies have to check.

ReplyDeleteI intend to get long steel, but just have to wait for a better entry, not likely these gaps will fill anytime soon. X, AKS, CLF targets.

Gold equities seem to want to lift some here.

Good luck guys, interesting times.

Current longs PCRX RRC CX

DeleteIf Trump is going to cut taxes, he will not have the budget in the near future to start massively building roads and bridges. Thus, there may not be any any massive copper consumption in the near future. Just placed a sell stop limit order on my remaining FCX below today's lows, $13.5/$13.45.

ReplyDeleteLooks like BTE might be making a double bottom here. Just bought some more shares at $3.82.

ReplyDeletePlaced a sell limit order for these shares at $4.32

DeleteBB -- OPEC overproduction is a temporary phenomenon, since they have already admitted that they want to reduce production to get the prices back up. Now it is just a matter of HOW this is going to happen. Apparently, OPEC might wait to see if Trump cancels the nuclear deal with Iran thus blocking their oil production:

ReplyDeletehttp://news.google.com/news/url?sa=T&ct2=us&fd=S&url=http://etfdailynews.com/2016/11/14/oil-plunges-once-again-as-opec-deal-hopes-fade/&cid=52779268743779&ei=jhIqWOmVJYfVjAGzmJb4BQ&usg=AFQjCNFYbbzQYzPZ9X7yRgQW424BT7IRIg

But one way or the other, the total output will soon be reduced. Apparently, all oil traders are short-term oriented now and are waiting for a clear outcome before piling back into oil...

David, OPEC is not a trustworthy organization and just because they something, or something makes economic sense, does not mean that they will do it. They have proven that over and over again.

DeleteAlso, if you look at the futures contracts, oil priced for Dec., 2020 is under $53. These longer dated contracts tend to be more based on real expectations of producers and users of crude who are using these to hedge projects, not traders, so even producers are not expecting a run-up anytime soon.

The issue with oil is you had huge capital overinvestment last decade with fracing, etc. and it takes time to work this off and no-one really knows how long this will take.

Financial stocks continue to kill it today and are amount the best performers of the market.

ReplyDeleteRegional Banks up 20% this month, XLF up 10%, pretty much all of the insurance companies I follow up 20%.

Big moves, but they are still among the cheapest stocks in the market and economic factors are moving to their benefit.

Might be hard to buy right now after the last week, but sure seems to me to be the easiest money around and I'd be looking for ones to buy if we get a pullback.

Man what a helluva move

DeletePicked up some OXY on close

ReplyDeleteOXY and RRC sold

DeleteCEF bought

A Rather Conflicted Market – Jason Goepfert of SentimenTrader noted the following:

ReplyDeleteMore evidence of a split market. On Monday, more than 300 securities on the NYSE reached a 52-

week high. More than 300 also reached a 52-week low, both accounting for a remarkable 10% of all

issues on the exchange. Never before have we seen anything even remotely like this. When both new

highs and new lows have made up more than 5% of all issues, then stocks have struggled every time in

50 years, as rare as it is.

"Never before" is a rarely seen phrase.

Per Cashin

Reminds me of the 2001 market where tech and S&P large caps were going down and small caps and value stocks were going up. I think too much money this time has gone into the yielders like utilities and staples and the compounders like growth tech. So now we see money rotating out of those areas pushing them to lows and into the undervalued areas and we are seeing highs.

DeleteMaybe the broad markets do poorly, but I feel good that you can finds stocks to work in this environment.

The more I read about Fannie and Freddie the more disgusted I get about our government. They blatantly stole their money and are refusing to abide by court rulings to release documents pertinent to the case. I am surprised the media isn't covering this more but I suspect the tentacles go deep on this one.

ReplyDeleteFCX dropped this morning just enough to hit my sell stop at 13.49 -- those algos are good! That's fine with me -- I'd be surprised if FCX does not drop below 13 soon. In the interim, I can make money elsewhere, like in oil! :)

ReplyDeleteALERT, Mike -- I just sold at $4.09 the shares of BTE I purchased yesterday without waiting for BTE to hit my sell limit at $4.34. This means BTE will soon hit my sell limit!

DeleteI was not taking small profits on BTE for a long time, and now that I have begun, it will surely move up! :)

I can't believe I deliberated on DRYS for an hour at $7.80 and passed because it ran too much. This is the biggest run I've ever seen.

ReplyDeleteMan, that's crazy. Now I don't feel so bad about selling out of MTL at $2...

DeleteWhat caused this stock to move up so much?

DeleteBB -- congrats on your move into financial stocks! Looks like your analysis was correct -- they were indeed cheap, and Trump's victory catapulted them up.

ReplyDeleteWhile some stocks had vertical run ups in the past week that are impossible to trade, BHP is still following a simple straight upward-sloping line since February. It is down almost 4% today, which brought it right back to that line. So I bought some just now at $36.33.

ReplyDeleteBought more BHP at $36.42 in my OptionsHouse trading account, where I only pay commissions of $3 per trade. Placed a sell stop limit at $36/$35.95.

DeleteI have been selling a lot of stuff today. Too big of a run and RSI's are at 80-90 on a lot.

ReplyDeleteSold out of all of my positions at the close. I know there's probably more upside here but I need to wait for pullbacks in some of these things.

DeleteI picked up some NMM after hours at $1.71 and BABA at $91.

Delete